Acceleware Reports Results for the Three Months and Year ended December 31, 2016 For Immediate Release

CALGARY, Alberta – April 26, 2017 – Acceleware® Ltd. (“Acceleware” or the “Company”) (TSX-V: AXE), a leading developer of high performance seismic imaging applications and RF heating technology, today announced results for the three months and year ended December 31, 2016 (all figures are in Canadian dollars unless otherwise noted).

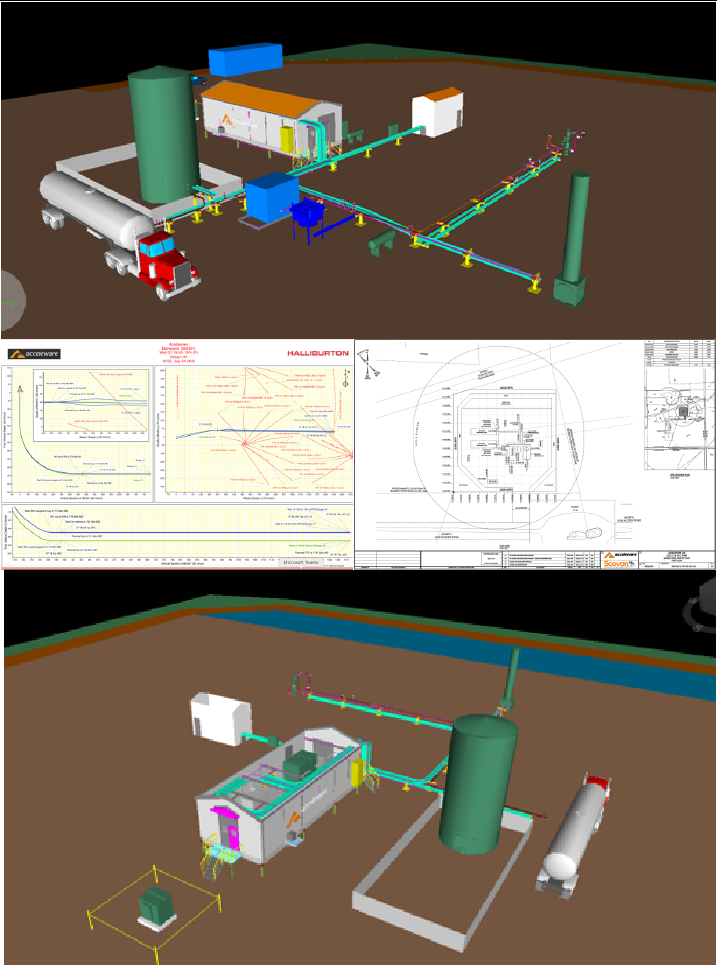

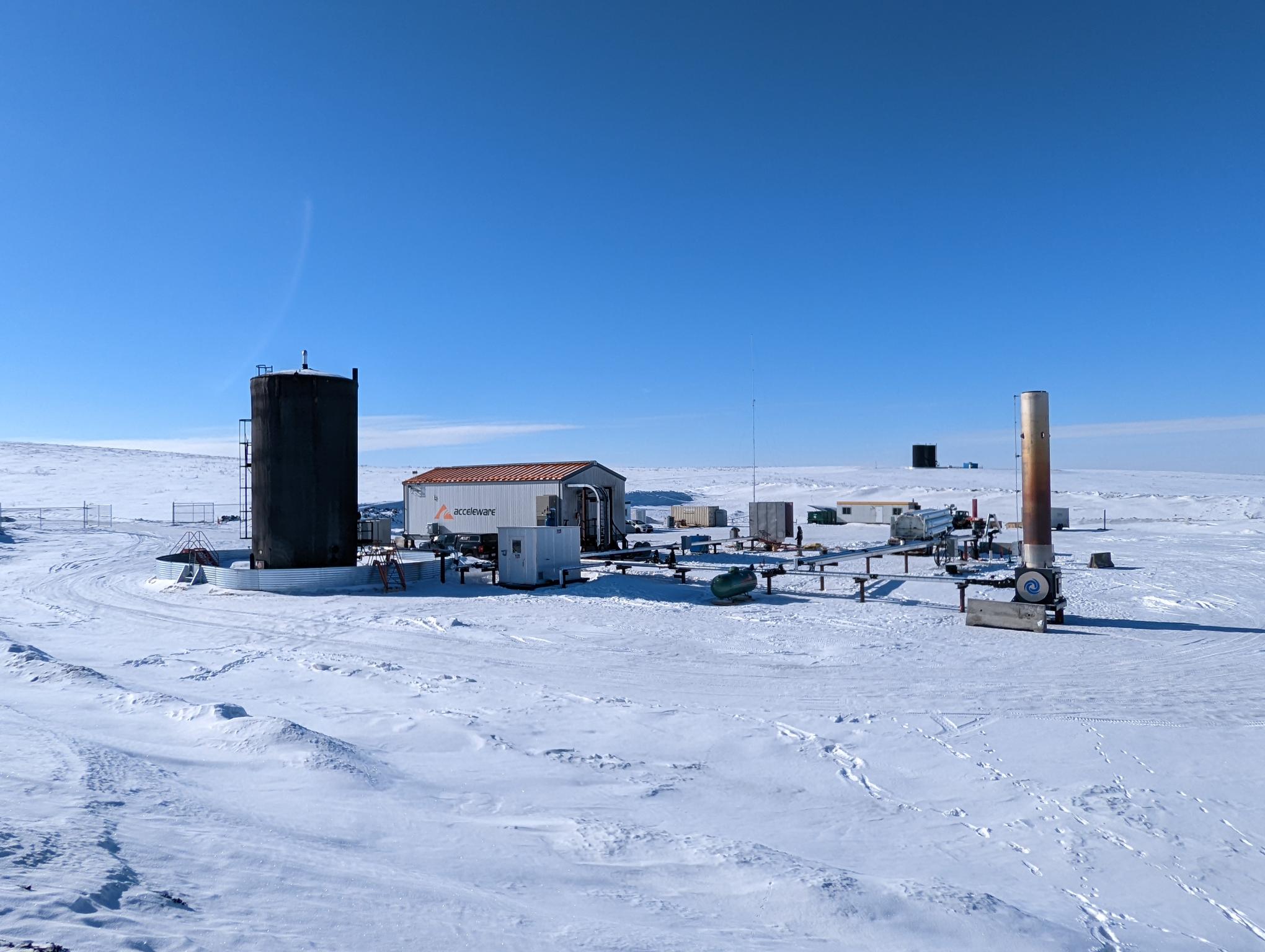

During the year ended December 31, 2016, Acceleware successfully achieved its objectives relating to the research, development and commercialization of its RF heating technology. Acceleware filed two RF heating patent applications and commenced preparation of two additional patent applications; initiated a technology partnership with GE; and commenced a field test of critical components of the innovative RF XL oil sands and heavy oil production technology. The Company raised gross proceeds of $2,925,000 in equity and convertible debentures to finance further development of its RF heating technology.

Acceleware’s software and services business continued to face a challenging oil and gas market, with recognized revenue of $1,395,169 - 50% lower than the $2,816,686 recognized during the year ended December 31, 2015. The decrease is primarily a result of a 62% decline in software product revenue, and a 44% decrease in consulting services revenue. On a segmented basis, the software and services segment revenue declined 47% in 2016 to $1,308,521 from $2,483,805 recorded in 2015. The Company’s RF heating segment recorded a 74% reduction in revenue in 2016, falling to $86,648 from $332,881 recorded in 2015.

|

Revenue |

|

Year ended December 31, 2016 |

|

Year ended December 31, 2015 |

|

Percentage change 2016/2015 |

|

RF Heating |

$ |

86,648 |

$ |

332,881 |

|

-74% |

|

Software and Services |

|

1,308,521 |

2,483,805 |

|

-47% |

|

|

$ |

1,395,169 |

$ |

2,816,686 |

|

-50% |

Acceleware had total comprehensive loss for the year ended December 31, 2016 of $2,010,009, compared to a total comprehensive loss of $219,273 for the year ended December 31, 2015. The increase is due to the above noted decrease in revenue coupled with a 7% increase in expenses, driven by higher cost of revenue and higher general and administrative expenses.

On a segmented basis, loss from operations attributed to the RF heating segment increased 65% to $1,982,266 in 2016 from $1,259,308 in 2015 due to higher research and development and general and administrative expenses. Despite the challenging year, the software and services segment continued to have positive income from operations, but fell 98% to $20,703 in 2016 compared to $951,801 in 2015 due to lower revenue.

At December 31, 2016, Acceleware had $1,616,415 (2015 - $585,117) in working capital, including $1,922,318 (2015 - $361,957) in cash and cash equivalents, and $58,095 (2015 - $37,160) in combined short-term and long-term debt in the form of finance leases. The Company issued $925,000 (2015 - $nil) (face value) in convertible debentures that accrue interest at 10% per year. The increase in cash (and consequently working capital) is a result of the Company completing an equity financing for gross proceeds of $2 million and the issuance of the convertible debentures in 2016 compared to $nil financing activity in 2015.

During the three months ended December 31, 2016 (“Q4 2016”), Acceleware had a total comprehensive loss of $953,737, compared to a total comprehensive income of $158,746 for the three months ended December 31, 2015 (“Q4 2015”). The difference is a result of an 83% reduction in revenue, combined with a 32% increase in expenses, especially R&D. Total comprehensive loss of $953,737 in Q4 2016 was also significantly higher than the loss of $324,722 recorded in the three months ended September 30, 2016 (“Q3 2016”) due to lower revenue, and higher expenses, particularly R&D.

|

Revenue |

Three months ended |

Three months ended |

Three months ended |

% change |

% change |

|||

|

RF Heating |

$ |

— |

$ |

87,379 |

$ |

— |

-100% |

N/A% |

|

Software & Services |

|

175,639 |

|

929,045 |

|

366,675 |

-81% |

-52% |

|

$ |

175,639 |

$ |

1,016,424 |

$ |

366,675 |

-83% |

-52% |

|

During Q4 2016, the Company recognized revenue of $175,639 representing an 83% decrease over the $1,016,424 recognized during Q4 2015. Revenue fell 52% compared to the $366,675 recognized in Q3 2016. As the Company focused on the development and testing of its proprietary RF heating technology in Q3 and Q4 2016, no RF heating segment revenue was recorded compared to consulting revenue of $87,379 recorded in Q4 2015. Software and services segment revenue was 81% lower in Q4 2016 at $175,639, when compared to $929,045 recognized in Q4 2015. The decline was reflective of a 91% decrease in product revenue. Software and services segment revenue was 52% lower in Q4 2016 when compared to $366,675 recognized in Q3 2016. The decline in revenue from Q3 2015 was caused by an 88% reduction in consulting revenue.

Acceleware continued to achieve milestones developing and testing its patent pending RF heating technology in Q4 2016. A second patent application was recently filed protecting additional innovations in the “RF XL” technology that directly applies to Alberta’s oil sands deposits, and work on further patent applications commenced in Q4 2016. It is believed that the RF XL concept can enable oil sands producers to be profitable at lower commodity prices while also reducing their environmental impact. Initial simulations and tests indicate that the technology has the potential to produce heavy oil and bitumen using 50% of the energy typically used in steam-assisted gravity drainage (SAGD) production, while requiring no external water use or solvent injection. In Q4 2016, the Company continued work on the first stage of a multi-stage field test program for RF XL. The first stage is a near-surface test of critical components of RF XL, partially funded by National Research Council’s Industrial Research Assistance Program. Acceleware and partner GE continue to work to adapt GE’s innovative silicon carbide power electronics technology to the RF XL concept.

Additional information, including the audited financial statements for the year ended December 31, 2016, and management’s discussion and analysis relating thereto, are available on SEDAR at www.sedar.com.

About Acceleware:

Acceleware is a public company on Canada's TSX Venture Exchange under the trading symbol AXE.

Disclaimers

This press release contains “forward-looking information” within the meaning of Canadian securities legislation. Forward-looking information generally means information about an issuer’s business, capital, or operations that is prospective in nature, and includes disclosure about the issuer’s prospective financial performance or financial position.

The forward-looking information in this press release includes information about the technical and economic feasibility of Acceleware’s RF heating technology. Acceleware assumes that the results of simulations, testing and economic modelling conducted to date are indicative of future performance of the technology.

Actual results may vary from the forward-looking information in this press release due to certain material risk factors. These risk factors are described in detail in Acceleware’s continuous disclosure documents, which are filed on SEDAR at www.sedar.com.

Acceleware assumes no obligation to update or revise the forward-looking information in this press release, unless it is required to do so under Canadian securities legislation.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

# # #

For further information:

Geoff Clark

Tel: +1 (403) 249-9099

This email address is being protected from spambots. You need JavaScript enabled to view it.

Acceleware Ltd.

435 10th Avenue SE

Calgary, AB, T2G 0W3 Canada

Tel: +1 (403) 249-9099

www.acceleware.com